2024 W-4 Forms For Employees – Here is a list of our partners and here’s how we make money. A Form W-4 is a tax document that employees fill out when they begin a new job. It tells the employer how much to withhold from an . Federal Form W-4 is used to help employers collect information needed to take out the proper amount of federal income taxes from employees’ paychecks. What the employee enters on the form will affect .

2024 W-4 Forms For Employees

Source : www.irs.gov

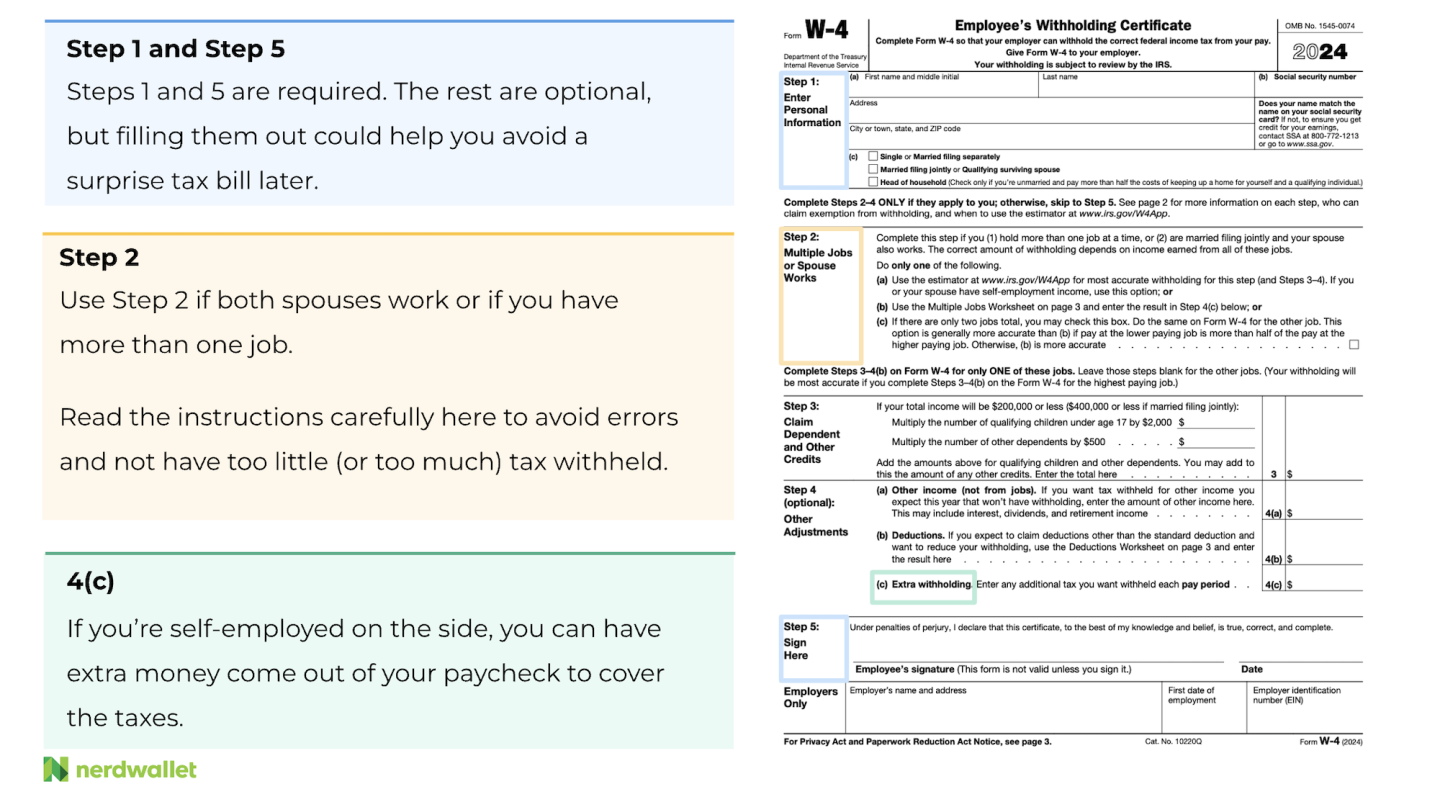

W 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.com

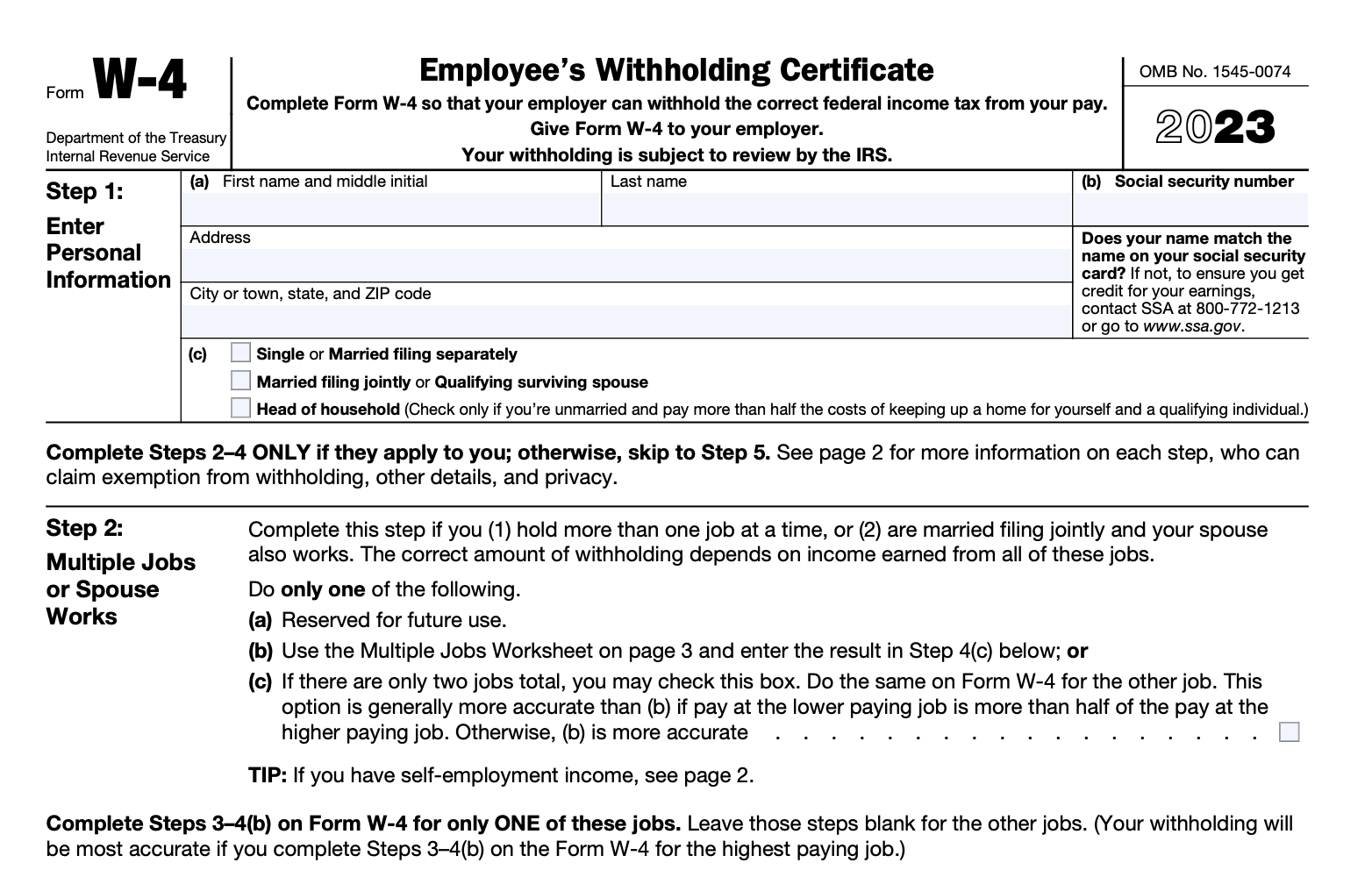

How to Fill Out a W 4: 2024 W 4 Guide | Gusto

Source : gusto.com

2024 Form W 4P

Source : www.irs.gov

W 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.com

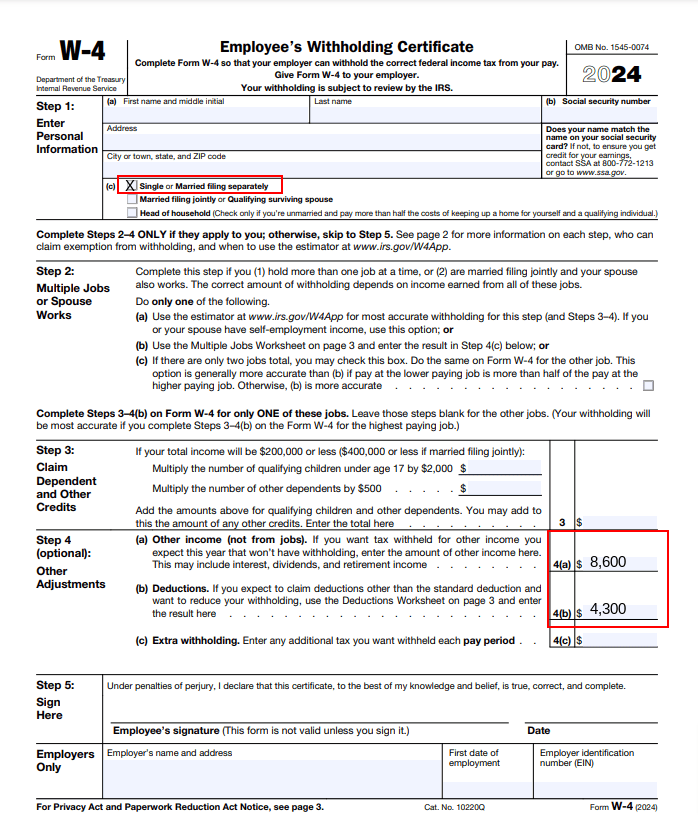

2024 IRS Form W 4: Simple Instructions + PDF Download | OnPay

Source : onpay.com

How to Fill Out the W 4 Form (2024) | SmartAsset

Source : smartasset.com

2024 New Federal W 4 Form | What to Know About the W 4 Form

Source : www.patriotsoftware.com

What Is the W4 Form and How Do You Fill It Out? Simple Guide

Source : smartasset.com

2024 New Federal W 4 Form | What to Know About the W 4 Form

Source : www.patriotsoftware.com

2024 W-4 Forms For Employees Employee’s Withholding Certificate: There are a lot of different tax forms the IRS requires you or your employer to fill out. Some of the most common ones are the W-2, W-4, 1099 and W-9. . An employee submits a W-4 to an employer to set income tax withholding from earnings. The employer then keeps this form in the employee’s personnel file. The Internal Revenue Service advises .